Based on our sample scenario above, let’s find the Bank of America Checking Account, and then click View register under the Action column. This will open the bank register, displaying all the transactions recorded for that account. Following this, you should carefully review the transactions and select the ones that need to be unreconciled.

QuickBooks Desktop Versions

The reason for this is so It’s not done accidentally. If a user was to accidentally undo a reconcile it could put them back for a lot of work they’ve put in. I’d be glad to assist you with unreconciling previous statements so they will not throw off your records. You may also consider looking for an accountant to Redo the reconciliation process. I am the company accountant and had to set myself up as if I were an outside accountant to get access to that button.

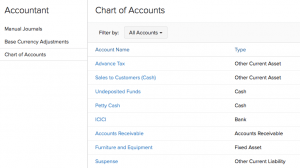

Step 1: Navigate to Chart of Accounts

To start the process, you would first need to open QuickBooks and navigate to the Banking menu. From there, you should select Reconcile and then locate the account for which you want to undo the reconciliation. Once the account is selected, you can click the “Undo Last Reconciliation” option. QuickBooks will prompt you to enter the date of the reconciliation how to calculate overtime pay you wish to undo. Following the ‘Delete’ button click, QuickBooks Online will prompt a confirmation dialogue to ensure the intentional initiation of the reconciliation deletion process. Once within the Reconcile Page, identify and choose the specific bank account for which the reconciliation undo process needs to be initiated in QuickBooks Online.

Reasons for undoing a reconciliation in QuickBooks Online

This process may seem daunting at first but with practice, it will become second nature. Undoing reconciliations in QuickBooks Online Accountant is just another tool in your arsenal for maintaining precise financial records for your clients. This process is crucial for maintaining financial accuracy and compliance with accounting standards. When transactions are unreconciled, it allows for the correction of errors, adjustments for returned items, or changes in financial status. By unreconciling transactions, users can rectify discrepancies, update or edit transactions, and ensure that the financial data accurately reflects the organization’s current financial position.

Troubleshooting Reconciliation Discrepancies in QuickBooks Desktop

If you need to completely start over, reach out to your accountant. It’s crucial to carefully review each transaction, ensuring that the changes made align with the accurate financial data. This meticulous process guarantees that the ongoing reconciliation process maintains integrity and reliability. This action triggers the ‘Delete Bank Reconciliation’ feature, allowing you to make adjustments and rectify any discrepancies in the reconciled transactions. Once the ‘Delete’ button is clicked, a confirmation prompt appears, ensuring that the user can confirm the deletion before proceeding. Undoing a bank reconciliation in QuickBooks Online follows a structured process to ensure the accurate correction of previously reconciled bank transactions and statements.

QuickBooks Online will automatically check transactions entered using the bank feed feature on the reconciliation screen. If your filters are set up incorrectly, you could reconcile a transaction that hasn’t cleared the bank yet, causing problems down the line. You will, however, want to regularly reconcile any short-term or long-term liability (loan) accounts to make sure the principal due and the interest paid are correctly accounted for in QuickBooks. The process for reconciling these accounts is the same as the process for reconciling a bank or credit card account, and it typically takes only moments to do. Click on the box with the R until it is clear, then click Save.

Even a small error in these details can throw off your reconciliation. It’s also important to verify that beginning balances match between your bank statements and QuickBooks records. Any variance here can lead to discrepancies down the line.

- They are there to assist you in resolving any complex reconciliation issues effectively.

- When reconciling an account, the first bit of information you need is the opening balance.

- Once on the Reconcile Page, identify and select the specific account for which you intend to undo the reconciliation in QuickBooks Online.

- Then I just used the arrow next to view report and clicked Undo.

- To initiate the bank reconciliation adjustment process, access the Reconcile Page within the QuickBooks Online platform’s interface.

- There is no requirement to be an accountant, to have a QBOA account, or anything else to be invited as the accountant user that I am aware of.

Before you start, you may want to download any attachments tied to the reconciliation. Undoing a reconciliation deletes all existing attachments. QuickBooks recently released a new feature that allows business owners to apply for a loan through its originating lender, the QuickBooks Capital. Allow me to share some information about undoing reconciliation. Please remember, I’m always here for any other questions or concerns.

If there’s a discrepancy, the bookkeeper may need to redo the reconciliation altogether. If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. Select the account by navigating to the ‘Account’ drop-down menu and clicking on the desired account.

Clicking the ‘Undo’ button triggers the system to reverse the previous reconciliation and brings up a new screen prompting for the reason behind the action. This allows for careful documentation of the adjustment https://www.adprun.net/ to ensure accurate tracking of changes. Once the reason is entered, the user can proceed to confirm the ‘Undo Bank Reconciliation’ action, completing the process and effectively adjusting the account.

If you see an error message in your beginning balance after clicking the Reconcile button, it means there are still errors in your records. Investigate the cause of the error by carefully double-checking your transactions and fixing the reconciliation again. The adjustment process may include adding missing transactions, deleting duplicates, or modifying transaction amounts to reflect the accurate financial picture. QuickBooks Online provides tools and reports to streamline this correction process, facilitating a smooth and accurate reconciliation. Upon clicking the ‘Undo’ button, QuickBooks Online will prompt a confirmation dialogue to ensure the intentional initiation of the reconciliation undo process. On behalf of John, you can look for someone with a ProAdvisor access.

Utilize the built-in reconciliation tools within QuickBooks Desktop to help identify and rectify any discrepancies that may arise during the process. Don’t hesitate to reach out for support from the QuickBooks community or customer service if needed. They are there to assist you in https://www.business-accounting.net/audit-and-it-audit-for-dummies/ resolving any complex reconciliation issues effectively. This process starts by accessing the ‘Banking’ module and selecting ‘Reconcile Now’ to navigate to the reconciliation window. From there, users can choose the specific account for which they want to undo the reconciliation.

Recent Comments